wv estate tax return

Tax Information and Assistance. How is the Estate Settled.

State Death Tax Hikes Loom Where Not To Die In 2021

Use the IT-140 form if you are.

. A When no return required-- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. A When no return required.

A When no return required-- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article. 110-CSR-1P Legislative Rule Title 110 Series 1P Valuation of Commercial and Industrial Real and Personal Property for Ad Valorem Property Tax. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map.

Property Tax Forms and Publications. Property taxes vary depending on the county in which you live. Tax Information and Assistance.

The schedule for determining whether an estate tax return is due can be found in the back of your appraisement booklet. The types of taxes a deceased taxpayers estate. 2014- form wv dor et 601 et 602 fill online printable.

In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a US Estate. Report Tax Fraud Join the Tax Commissioners Office Mailing List Tax Information and Assistance. Form 706 is used to.

31 rows Florence KY 41042-2915. IT-140 West Virginia Personal Income Tax Return 2021. 4810 for Form 709 gift tax only.

-- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the West Virginia Tax Divisions primary mission is to diligently collect and accurately assess taxes. B Returns by personal.

The sales tax rate is 6 and the gas tax rate is 186 cents per gallon. 304 558-3333 or 800 982-8297. Fillable-Forms Forms and Instructions Booklet Prior Year Forms.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. B Returns by personal representative. When does the Estate Appear on the West Virginia State Tax Return When a person dies the estate state tax.

For 2000-2001 the exemption equivalent was 675000. -- The personal representative of every estate subject to the tax imposed by this article who is required by the laws of the United States to file a federal. A full-year resident of West Virginia A.

B Returns by personal. Payment of Additional Estate Taxes in WV. In West Virginia the first 10000 in.

Information about Form 706 United States Estate and Generation-Skipping Transfer Tax Return including recent updates related forms and instructions on how to file. West Virginia Estate and Inheritance Tax Return Engagement Letter - 706 Get state-specific forms and documents on US Legal Forms the biggest online library of fillable legal templates. Department of the Treasury.

Understanding The Estate Tax Return Marotta On Money

Et601602 State Wv Us Taxrev Taxdoc Tsd

Complete Guide To Probate In West Virginia

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Property Tax Forms And Publications

West Virginia Income Tax Calculator Smartasset

2008 Individual Tax Return Instructions

10 Ways To Reduce Estate Taxes Findlaw

Pay Taxes Kanawha County Sheriff S Office

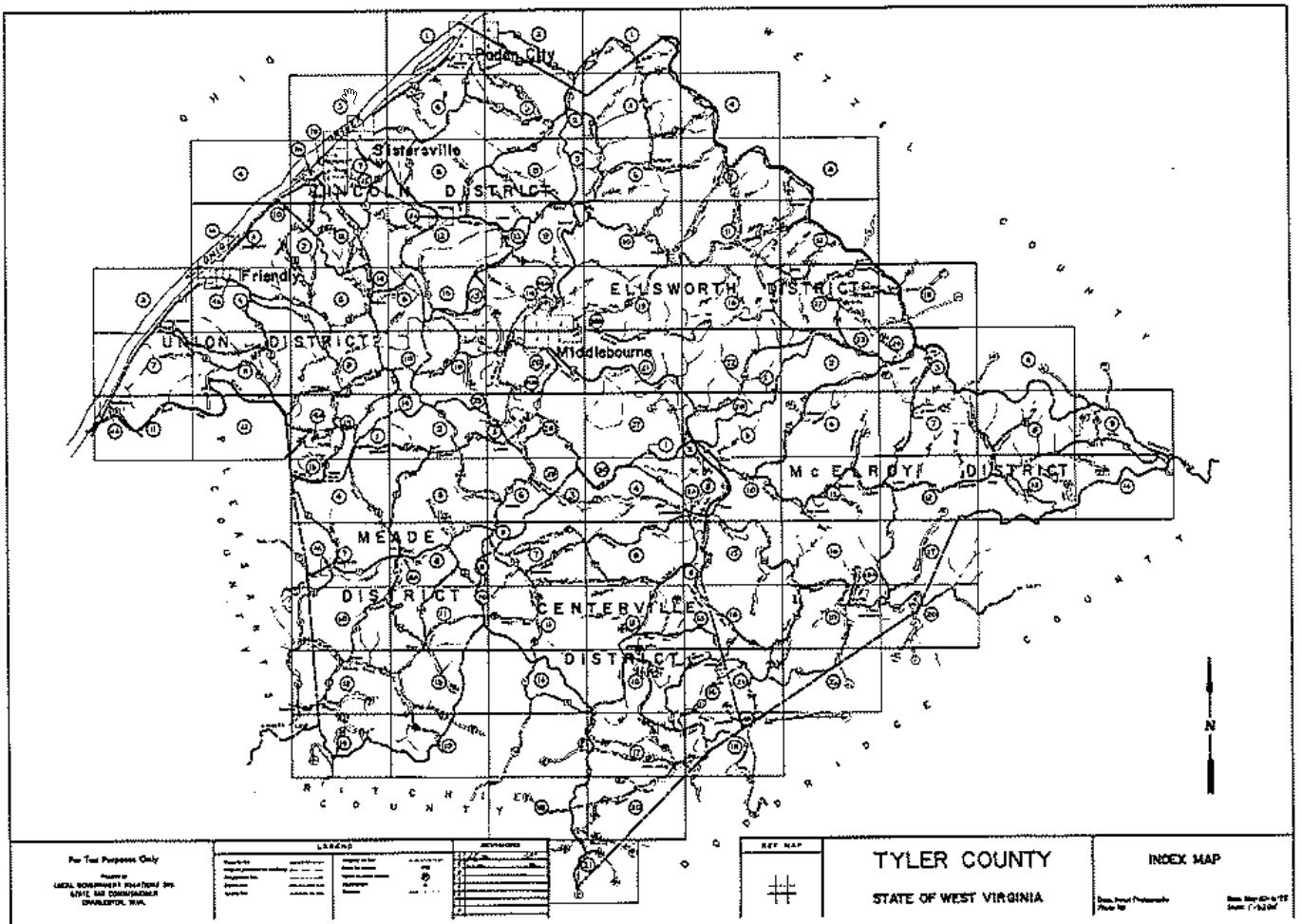

Tyler County Assessor Tyler County Government Services

West Virginia Income Tax Repeal Evaluating Plans Tax Foundation

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

States With No Estate Tax Or Inheritance Tax Plan Where You Die

West Virginia Escheat Unclaimed Property Laws Sovos

Pdf The Federal Estate Tax History Law And Economics Semantic Scholar